Back in the Game: AI's Sputnik Moment & What It Means for Vertical SaaS

Back from a 3-month sabbatical with fresh insights on vertical AI, tax tech, and the changing landscape of startup leadership

Hey everyone!

After a three-month break from writing, I'm excited to reconnect with this community. During my time away, I've been deeply immersed in building and working on a new company, getting my current company to a solid place, and investing and advising in the next generation of companies across #accountech, #taxtech, and vertical AI being applied to professional services. The tech landscape has evolved dramatically since my last post in October, particularly in how we think about building and scaling AI-powered companies.

What I've observed during this period has fundamentally challenged the conventional wisdom about startup team building, especially in regulated industries. Today's newsletter explores these insights through the lens of recent breakthroughs in AI efficiency and their implications for solo founders.

Let's dive in...

While large companies chase AI efficiency, we're already using it to find hidden money. By directly interfacing with the IRS, we recently helped a startup recover $80,000 in unclaimed refunds sent to old addresses - a common issue during rapid growth. Our IRS verification uncovers these opportunities in 24 hours, with no complex technology required. See if your business has unclaimed funds

What Caught My 👁️...

The Sputnik Moment for US AI companies

This weekend, a Chinese company called DeepSeek shot to the top of Apple’s App Store charts with a recent breakthrough in AI efficiency creating fear that the trillions of dollars being spent and planned to be spent on foundational models, GPUs, and more over the next few years is a bad investment. Well, that is how Wall Street took it as Nvidia lost $589 billion in market cap. The key takeaway – it's about efficiency and restraints (unless you believe the conspiracies that this company had access to up to 200,000 high-powered Nvidia H100 GPUs as opposed to the 50,000 their white paper claimed.

Sputnik Moment (PMarca’s X)

The Short Case for Nvidia Stock (YouTube Transcript Optimizer)

Meta Scrambles After Chinese AI Equals Its Own, Upending Silicon Valley (The Information)

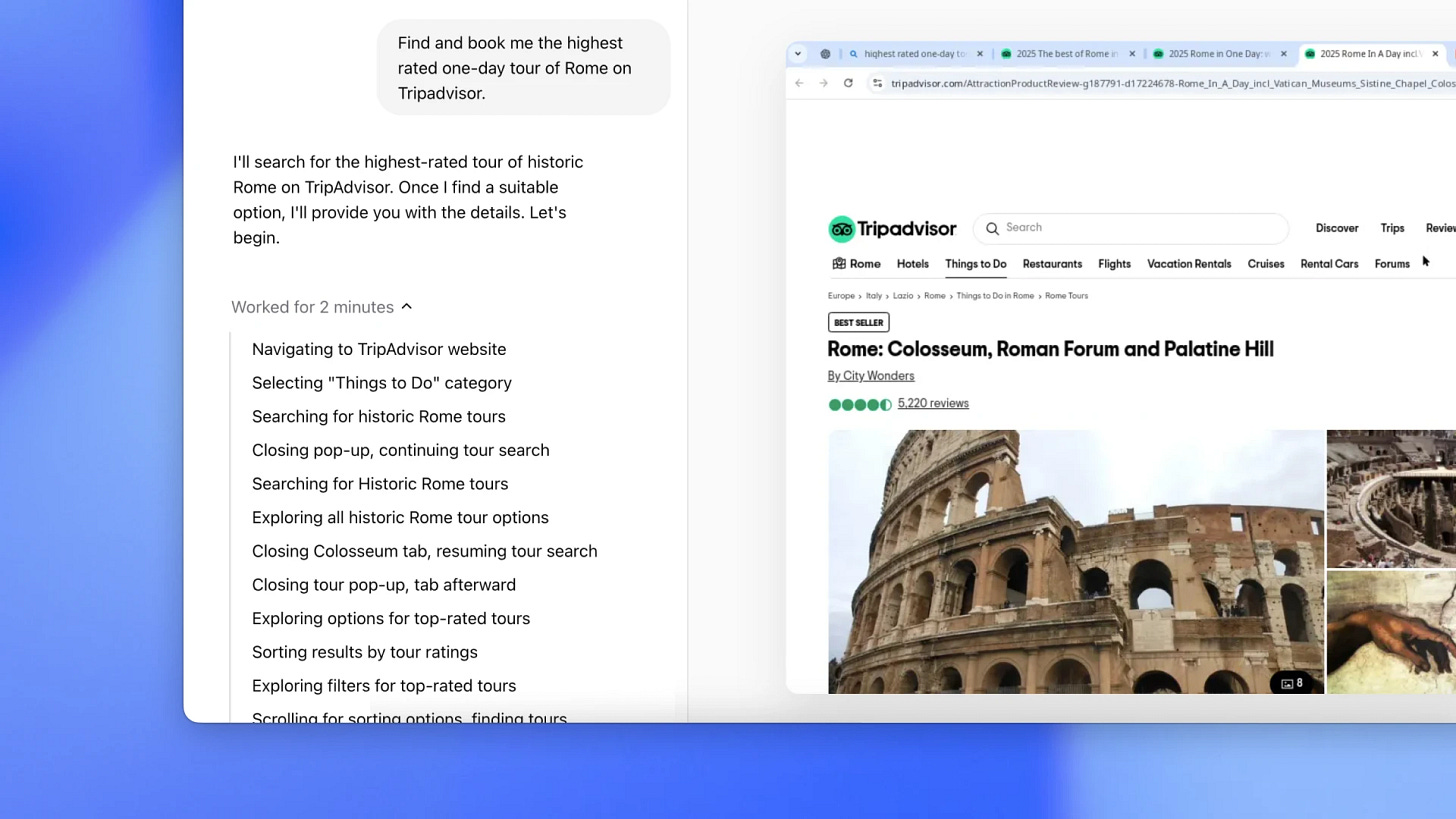

OpenAI's Operator & The Future of data collection

OpenAI's release of an Operator capable of autonomously performing web-based tasks has massive implications for tax data collection and processing. This technology could revolutionize how we think about data collection and document gathering on the internet – a core focus of what I am working on with my new company correlates to the problems that a solution like this can solve. The ability to autonomously navigate online portals and extract relevant information could reduce what currently takes days to minutes or seconds even.

Introducing Operator (OpenAI website)

OpenAI Unveils A.I. Agent That Can Use Websites on Its Own (WSJ)

Early-Stage Funding Landscape

Having just invested in Open Ledger's pre-seed round (led by Kindred VC + Blank Ventures), I see a clear pattern: investors are heavily betting on second-time founders and vertical AI applications in regulated industries. The thesis? Domain-specific AI solutions will deliver more immediate value than general-purpose AI tools. With OpenLedger, they are focused on the accounting stack and helping vertical SaaS companies (primarily) attack Intuit’s Quickbooks Suite. Intuit and Quickbooks continue to push into payments for small businesses and this makes the accounting suit i.e. “owning the GL” even more important for vertically focused companies. There will need to be a bevy of these types of companies to compete and help software companies get more revenue by adding financial services, accounting, tax, and data solutions to their core offerings. Congrats to Pryce and his co-founder Ashton Bell and thanks for letting me play a small part in the round.

A 24-year-old who exited his first company to Coinbase raises $3M for his next venture (Techcrunch)

Make sure to schedule a demo with their team linked below if you are building almost any kind of software company serving businesses.

Quote of the week

Poker is all about watching others and sometimes misdirecting them about the strength of your hand, and Altman became so good at bluffing and reading his opponents’ subtle cues that he used his winnings to fund most of his living expenses as a college student. “I would have done it for free,” he would later tell one podcast. “I loved it so much. I strongly recommend it as a way to learn about the world of business and psychology. — Sam Altman on his early love for Poker, Supremacy: AI, ChatGPT, and the Race that Will Change the World

Until next week,

Matthew

Want to discuss tax tech, vertical AI, or early-stage investing? Reply to this email or connect on LinkedIn, X, Fundraising Newsletter.