Recapping two big exits totaling $1.2 billion in cash and FTX collapses nearly overnight

Stretch Four Insights Volume 42

The newsletter is brought to you by…Future

One thing my trainer has been implementing into my workouts lately is box jumps. At 35, I am not what I use to be but I have been pushing myself each time to jump higher, right now I am stuck at 36 inches but my plan is to take it up to 42 inches by the end of the year.

This is all powered and tracked by the Future app. It gives me a mix of workouts and I get a personal trainer who keeps me engaged with various challenges, text messages, and inspiration throughout the week. I would never be pushing myself to get to 42 inch box jumps without him.

Want to sponsor a newsletter or deep dive? See our sponsorship information here.

Happy Saturday,

It has been quite the week in the technology sector with Elon’s takeover of Twitter getting off to a rocky start to say the least, the near overnight bankruptcy of Sequoia Capital’s crypto darling FTX, and a complete reversal from the NBA, the Brooklyn Nets and sports media’s position on Kyrie Irving.

For me, this weekend is my first weekend alone with my son Cain, who is now eight months.

While things seem to be down in terms of massive layoffs I had a great meet up this week with some fellow founders and friends here in SF, and we had broad discussions about things happening across a technology, specifically fintech which has been hit harder than most other areas with layoffs, down rounds, and just a more frothy market than others. It was unique because we had a good representation from a founder perspective. One of us who had sold his company and recently joined a two-person team that raised a $6 million seed round — and has a fairly optimistic view of things, someone who has been going on for a few years and has had their fair share of ups and down, myself, and someone starting their first company. I felt overall refreshed from our conversations and despite the proverbial down year in technology there are still things to be excited about on many fronts.

This week I want to highlight:

Two exits in the past few weeks related to tax and accounting for startups and consumers. Shows a hot and consolidating market!

The “King of Alturism” Sam Bankman-Fried goes from a $20 billion net worth to $0 in a week

Let’s dive in.

Quote of the Week:

They were shocked when I showed up from Silicon Valley with a completely different mindset: pedal to the metal, put your boots on, execution is everything, business is war. You can imagine how well that went over. - Frank Slootman, on taking over San Diego based Service Now from his book Amp It Up

Chart of the Week:

Tweet of the Week:

Everyone can’t win. CZ, the CEO of Binance enjoyed the meltdown at FTX this week and this tweet was a his big humble brag.

Two major exits for the #taxtech industry in the past two two weeks

As a startup founder, this has been a fairly insightful as well as inspiring past few weeks. There have been over $1.2 billion in exits for technology companies in the tax industry. I want to highlight two adjacent companies to what we are building with ModernTax and give my take on what it means for the industry as a whole.

TaxAct exits for $720 million in cash

Cinven purchased TaxAct and plans to merge TaxAct and Drake, which it made a substantial investment in just last year.

This consolidation is interesting as the tax industry is becoming a target for venture dollars with my company (ModernTax), Column Tax, and April receiving venture funding among others.

There are clearly ways to make money within tax technology products and while Tax Act serves as a filing solution it is a fairly commoditized landscape with the primarily leader being Intuit’s TurboTax.

Despite this $720M is a real dollar exit that sends signals that there is opportunity for growth.

While TaxAct competes with TurboTax, HR Block, and others here in the states the primary plan for Cinven is integrating it with Drake Tax Software. This creates a strong moat across both tax professionals who use Drake and do-it-yourself tax filings that can be completed on TaxAct. I could see a TurboTax Live type product experience being built here. It makes since because Drake offers a white-labeled solution and already has nearly 65,000 tax professionals using their software and reportedly filed 33 million tax returns in the US in 2021. It will be interesting to see how these two companies work together and what Cinven’s end goal is to with bringing the two entities together.

SurePrep exits for $500 million to Thomas Reuters

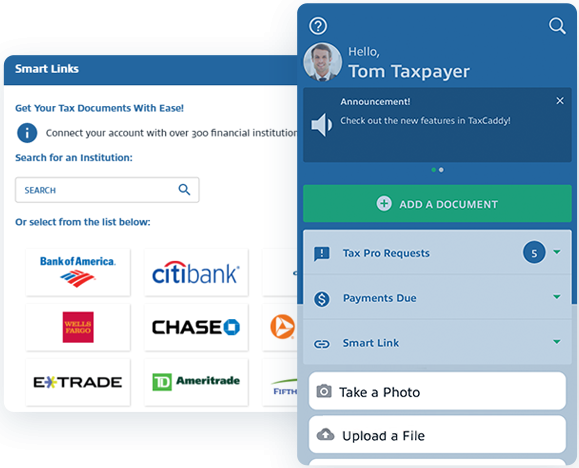

SurePrep is a company that I have been aware of for a while. While tax professionals use software like Drake Software for the actual filing, they use products like SurePrep for the work related to onboarding clients, form and data collection, and sharing final return documents in a secure portal.

The $500 million cash exit this week to Thomas Reuters, which will complement their tax and accounting division which includes offers products to accounting firms among other industries like corporations and governments. My hunch is this is a direct move after the TaxAct acquisition by Cinven.

SurePrep raised its first outside capital in 2019 from private equity firm Bregal Sagemount and now exits for what is likely an 8.3x multiple as reports are that SurePrep was set to do about $60 million in revenue in 2022.

What does this all mean?

From my perspective and obviously I have interest due to our business at ModernTax where our mission is to build the data graph that houses all tax records and data on US consumers and businesses. Most of this information not only lives in the IRS’s system of record but in products like TaxAct, Drake Tax Software, and SurePrep. These software solutions are utilized by the tax and accounting professional industry and it shows how large the opportunity is with nearly 85,000 paid practitioners in the US alone. There is already lots of money being made in aggregate for tax services and as this data becomes more accessible to financial service companies who we sell to it can be used to build even more innovative financial products. This also shows there are exit opportunities. We have now seen lots activity just this month in what many would call a near recession level market but these exits prove that in the tax industry there are strong reasons to believe it is recession proof. I think we will continue to see more over the next 18 months but the average age of these companies are well over 10 years so there are longer time horizons for tax technology companies. The market is waking up to the industry and recognizing there is lots of money to be made outside of the traditional mass-market products offered by Intuit.

SBF’s and the FTX meltdown plus a Bahamian Estate for rent

This week the technology sector was overtaken by the meltdown at FTX. While a company going from a combined $30 billion valuation for both the FTX and FTX.US business to filing for chapter 11 proceedings in less than a week is a phenomenal statistic in itself, the ongoing developments are even more interesting.

Forbes quoted that FTX was, “brought to its knees by its fiercest rival Binance” and that is likely an understatement. CZ the founder of Binance, the largest competitor to the now bankrupt FTX, exposed the underlying FTT token and made a major attack on it which led to massive exposure. While CZ, admits that crypto as a whole is set back a few years because of this FTX meltdown, the FTX story is made for TV and I am sure the likes of Netflix, HBO, Showtime, and everyone else will be looking to capitalize on the story. Ironically, Michael Lewis the best selling author has been following SBF, the FTX founder, around the Bahamas working on a book for some months now.

If you are in the market for a $35 million penthouse in the Bahamas the one linked below is available, it is where the SBF was living prior to this week.

What’s Next

Next up for me is I am heading back home to Charlotte for a week. I will be pitching at the Venture 135 Conference which takes place on Tuesday and Wednesday at the Barings Center in Charlotte.

If by any chance you are in Charlotte and you are into either fintech or insurtech here is the link for half off the registration.

As always if you have feedback on the newsletter shoot me a note at matt@stretchfour.co.

Back to the trenches.

Best,

Matt