Venture capitalists run for the hills, MainStreet and OnDeck layoffs, 40-year-old and up founders, Black CEO hiring dilemmas

Stretch Four Insights Volume 23

Happy Saturday,

This week Twitter was a blood bath as the market continues to slide. Overall this looks like a slight correction but many are taking the opportunity to spread gloom and doom verbiage all over the internet.

This week I will recap:

The supposedly drying up of venture capital dollars primarily for growth funding rounds.

Two companies with predictable layoffs

Why older founders are having more success

Black CEO hiring trends and Twitter debates

Let’s dive in.

Venture capital funding drying up?

If you’re engaged with #VCTwitter this was a depressing week. Every VC was screaming doom and gloom from the top of their Twitter feeds. Back-channel conversations with investors are not much better. The primary reason we are hearing this rhetoric is that the public market is a snapshot of what the private market will look like in the future and it is bad out there.

So what do I make of it? Well, some of these same VCs were plowing capital into overvalued startups last year at this time so it is odd to see the tune change so quickly. Eric Newcomer’s piece showed the timeline of how things have changed in terms of venture investments. As much as the market is shedding value at very high rates, deep down those VCs with dry powder will likely just get big discounts and continue to invest in their portfolio winners who need more cash. The best investors will also take advantage of getting in deals that might not have been available to them just three months ago.

A good follow on Twitter is Shai Goldman (@shaig) who is keeping updated tabs on the largest new VC fund announcements:

Two layoff announcements you could of predicted

This week there were more startups that announced layoffs than in the entire first quarter. Two stuck out to me because I honestly feel like these companies had shaky foundations from the beginning.

Mainstreet

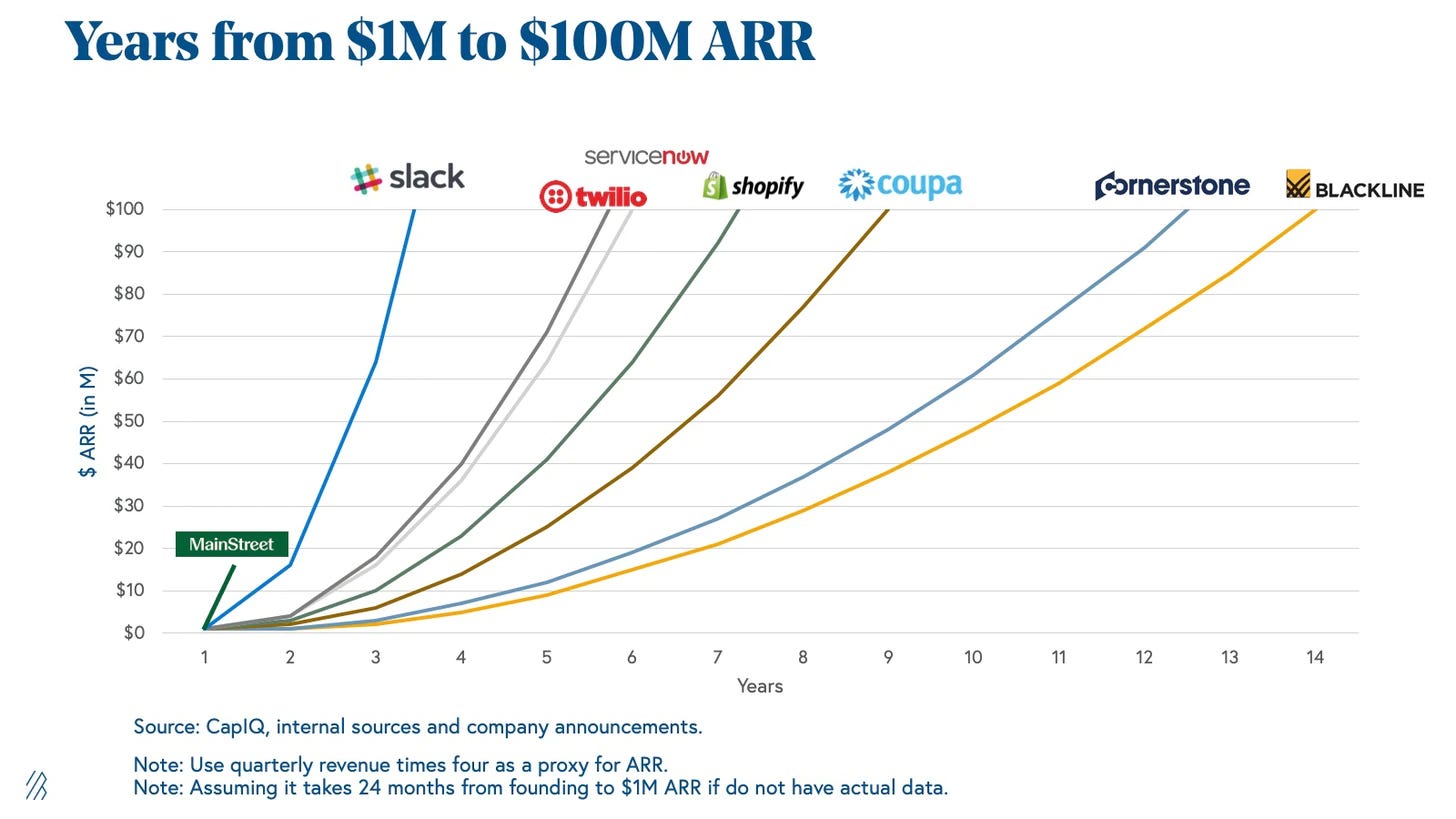

Mainstreet is an R&D tax credit company that Packy Mccormick now infamously said was the fastest company to reach $15M in ARR. Even putting it beside companies from the Bessemer Cloud Index as an example. No dis to Packy who said it was not pure SaaS revenue but Mainstreet rode that narrative after raising a $60m Series A round in March 2021. Despite the hype, the business model had holes from the beginning. For one R&D tax credits are not necessarily “free money” from the government, you actually receive the credits by allowing your payroll provider to credit you and take less of your payroll expenses each month. Mainstreet’s go-to-market adoption was built around aggressive marketing to startups on social media and advancing early-stage startups the money upfront and charging their fees from the advance, which from what I understand was all being done on Pipe. Beyond this, a one-week company-wide offsite at Grand Waleia in Maui likely does not help the balance sheet much. The company reportedly flew out the entire 150 employees in January 2022 while expecting a lofty Series B fundraising. The money did not come as they thought and they shed 50 (~30%) of those same employees not even six months later.

Ondeck

OnDeck is building a community but this week the company announced layoffs galore. They announced a 25% layoff of all staff effective immediately. Somehow OnDeck, whose business model consists of pay-to-play boot camps across a wide range of things like startup-specific roles, floundered on raising funds for an accelerator. When I checked LinkedIn over 2,300 people are listed. OnDeck, always seemed like it lacked focus. This reset shows that it was overhiring and now has to reset after probably not being able to raise a large Series B and close the venture fund that was intended to be funded by Tiger.

Older founders

What’s it like being a startup founder over 40?

This article came across my radar this week and had me thinking. As I approach 35, it is interesting to reflect on my five years in the startup grind as an entrepreneur it seems like a younger person’s sport. However, this article hit on a few themes that contradict that. 50-year-old founders are twice as likely to create a high-growth startup than a 30-year-old rival and while the pace is definitely built for someone younger the self-confidence, network, and experience more than makeup for it.

Are black startup founders hiring predominately white teams?

The above tweet caught my eye and kind of struck a chord. The premise is that black startup CEOs hire mostly white employees. This is a hot-button issue in the black tech startup community. I have a few takes.

Many talented black operators aren’t dying to work at a startup or wanting to take less pay full stop to work at a technology company.

Talented black operators choose to work in big tech vs joining black-founded early-stage companies.

Black founders typically already struggle with hiring in general, add the funding biases and I think it’s clear why we don’t see as much diversity as we should early on.

I have been in the Bay area for five years now and I consistently see black professionals that work in tech working at large established companies. There are a few things happening here. Many black professionals do not come from backgrounds where they are able to take less pay for years which is what the early stage startup market jobs have traditionally been about taking less pay. Number two, many times those working at the big brands are looking for the stability and the pedigree that comes with being a part of a large successful organization.

Someone in the thread brought up Calendly, a unicorn founded by a Nigerian American founder in Atlanta. What is missing is that Calendly only recently became a household name. The company was founded in 2010 and bootstrapped until 2014 and then raised a large round last year when it made the big mainstream splash. The point here is startups are hard, especially for black founders. In the early days, you are not able to think about diversity in most cases. You are trying to build a product that people want, will pay for, and raise money.

Other News

Yuga Labs costs the community $100M (The Ground Floor)

NIL is revving up! (Front Office Sports)

Plaid 🆚 Stripe (Hacker News)

Crypto Mixer crackdown (The Record)

What’s Next

This Wednesday we are starting our new Long Four weekly drop which will also include the launch of the Stretch Four audio version where I will read the post.

This weekend, I am spending time with the wifey on her first mother’s day weekend. She is holding things down two months into our life as parents and still maintains a sharp editor’s touch for this newsletter.

Back to the trenches.

Best, Matt